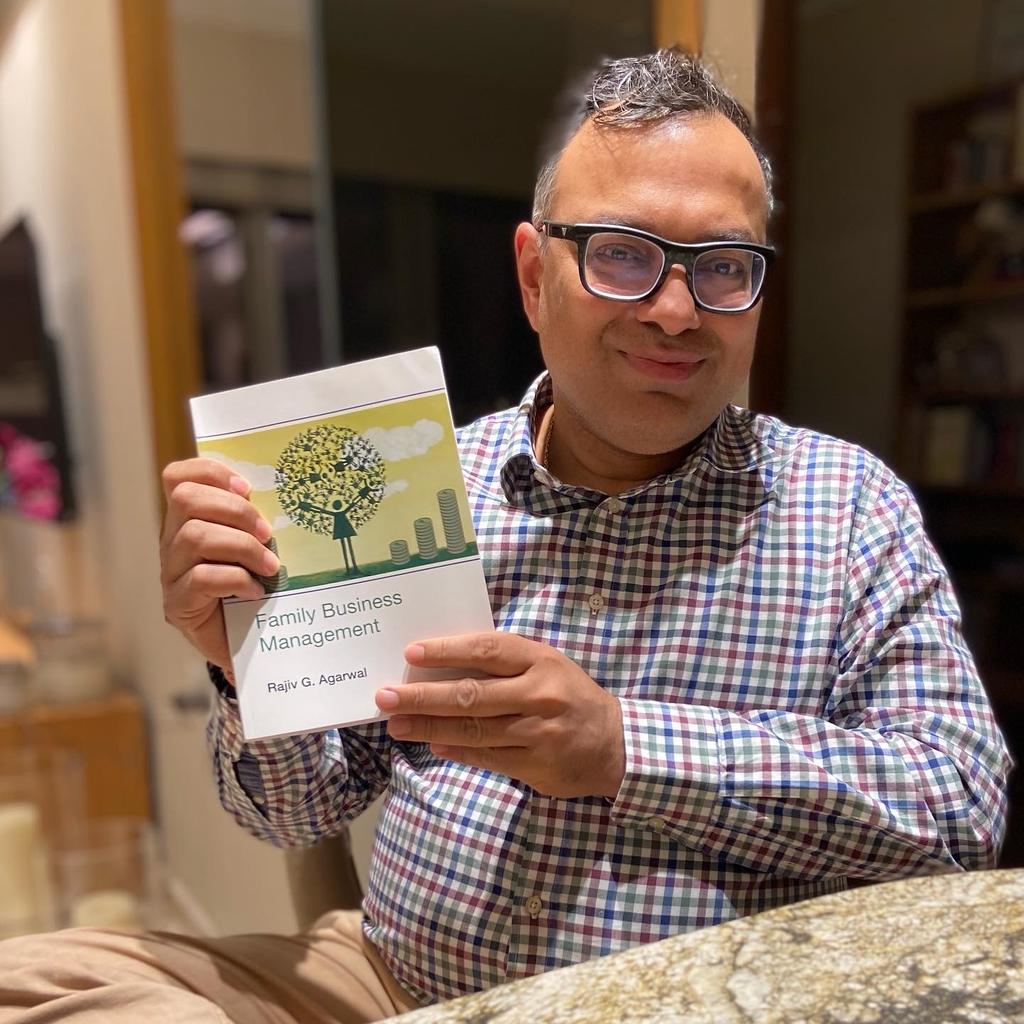

He is currently Professor, Strategy, Family Business and Entrepreneurship at SPJIMR, Mumbai, (a top 5 MBA school in India). He also Head, Strategy Group at S.P. Jain Institute of Management & Research (SPJIMR).

He has written extensively in many newspapers and magazines like Economic Times, Fortune India, Business Today, Forbes, Inc. USA, etc. He has also given many keynote speeches in India and abroad.